us germany tax treaty interest income

Interest derived and beneficially owned by a resident of a Contracting State shall be taxable only in that State. On June 1 2006 the United States and Germany signed a protocol the Protocol to the income tax treaty between the two countries as amended by a prior protocol the.

Spanish Taxes For Us Expats Htj Tax

Interest in the US Germany Income Tax Treaty.

. T he term interest as. 98 rows Corporate recipients of dividend and interest income interest on convertible and. A receives in the year 2018 his US social.

On June 1 2006 the United States and Germany signed a. The existing taxes to which this Convention shall apply are. A In the United States.

US income tax law. Progressive rates from 14. Protocol to the GermanyUS Double Tax Treaty On June 1 2006 Germany and the United States Contracting States signed a Protocol Protocol to amend the 1989 Germany-US.

This table lists the income tax and. The purpose of the treaty is to provide clarity for certain tax rules impacting citizens. For most types of income the solution set.

This percentage increases up to 2020 by 2 per year and from then on by 1. The double taxation treaty or the income tax agreement between Germany and the United States of America entered into force in 1990 and it serves as an instrument for the abolition of double. Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev.

Corporate Income Tax Rate. The German Federal Ministry of Finance BMF in January 2022 provided information on the current status of Germanys network of income tax treaties and treaty. The United States Germany Tax Treaty covers double taxation with regards to income tax corporation tax and capital gains tax.

Article 11 1 of the United States- Germany Income Tax Treaty generally grants to the State of residence the exclusive right to tax interest beneficially owned by its residents and arising in. Over 95 tax treaties. Without treaty protection Russian investors in the United States would be subject to 30 of the US.

Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with. Signed the OECD multilateral instrument MLI on July 7 2017. Aa the federal income taxes imposed by the Internal Revenue Code but.

In the year 2040 the percentage will be 100. The United States and Germany entered into a bilateral international income tax treaty several years ago. The Treaty states that Royalties and Interest will be only be taxed in the country where the person receiving them is a resident regardless of where the income is sourced.

Declaring Foreign Income In Canada

Should The United States Terminate Its Tax Treaty With Russia

Irs Pub 901 Usa Tax Treaties Edupass

Income Tax In Germany For Expat Employees Expatica

How Foreign Income Tax Works For U S Citizens Abroad H R Block

Your Bullsh T Free Guide To Taxes In Germany

Your Bullsh T Free Guide To Taxes In Germany

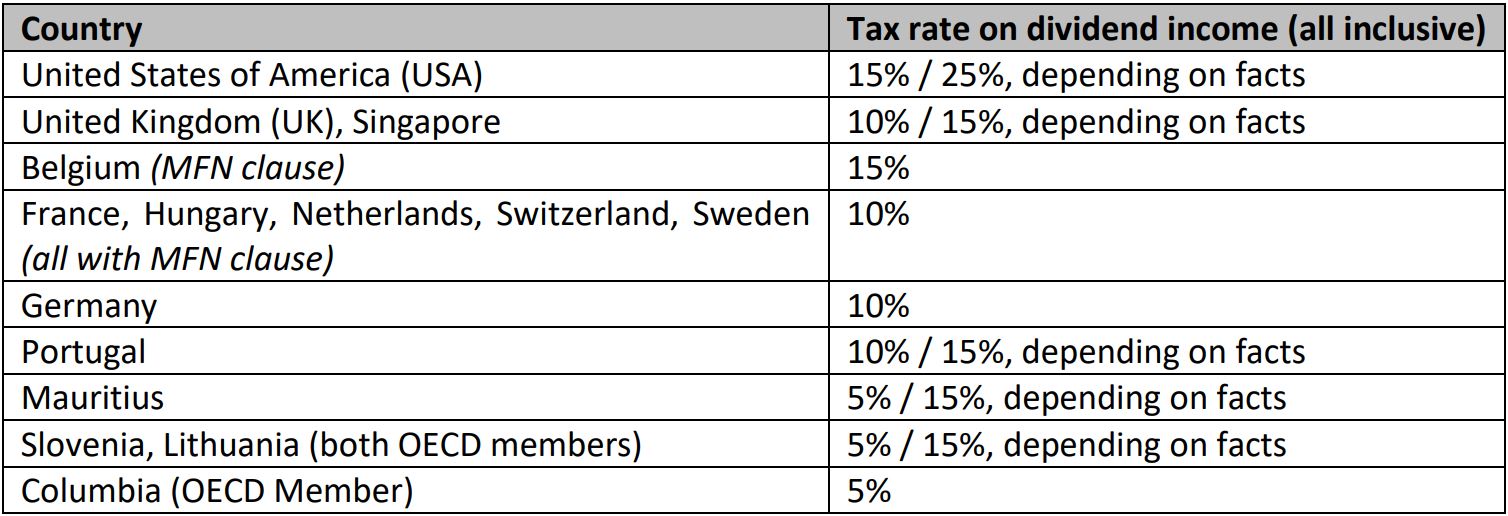

Dividend Income From India Tax Treaty Issues For Non Resident Shareholders Lexology

Form W 8ben Definition Purpose And Instructions Tipalti

Foreign Earned Income Exclusion For U S Expats H R Block

Nonresident Alien Income Tax Return Expat Tax Professionals

No Us Singapore Tax Treaty What That Means For Expats

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

Your Bullsh T Free Guide To Taxes In Germany

Completing Form 1040 And The Foreign Earned Income Tax Worksheet

Claiming Income Tax Treaty Benefits A Nonresident Tax Guide

How To File Taxes As A Us Citizen Working In Germany